SOLUTION

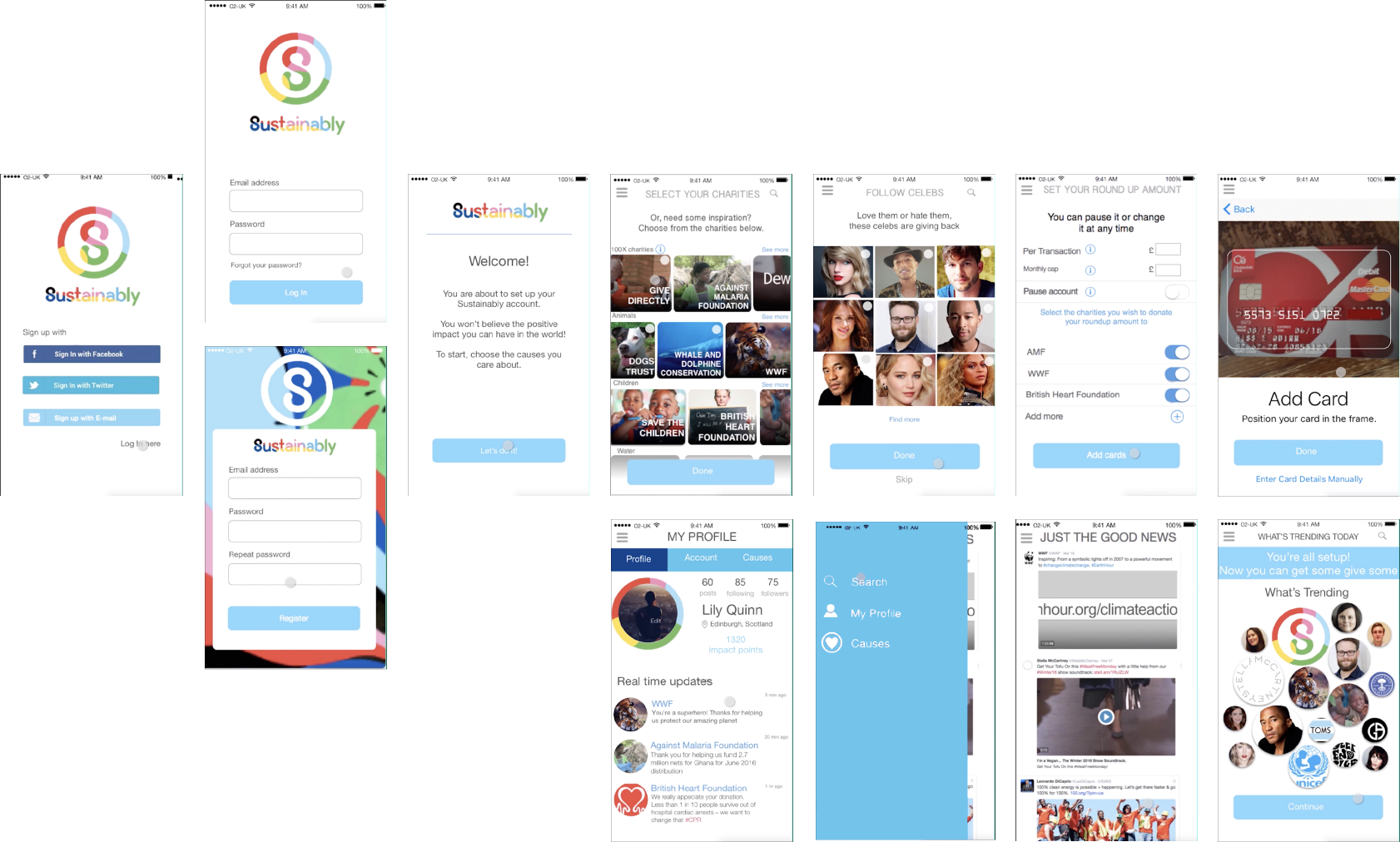

Inspired by Penny for London and pushed open banking API plan in the UK(announced by government last month), our idea is to provide a transparent social platform for millennials to donate pennies to good causes they care about, with bank cards through everyday purchasing.

By designing the app as a form of social network, we addressed the challenge of the hackathon, which is designing finance products for millennials. With our app, millennials can follow their favorite celebrities, bands, friends and what they are caring about. In the meantime, shops and employers can give rewards by donating to causes customers and employees care about.